As a limited company business owner or director, one way you can raise capital, reward employees or facilitate business expansion is by issuing new shares in your company.

Issuing new shares is a common practice, but it’s important to understand the process and implications from a legal perspective. In this article, we’ll guide you through the process and answer some of the key considerations when issuing new shares in your UK-based limited company.

Can a limited company issue new shares?

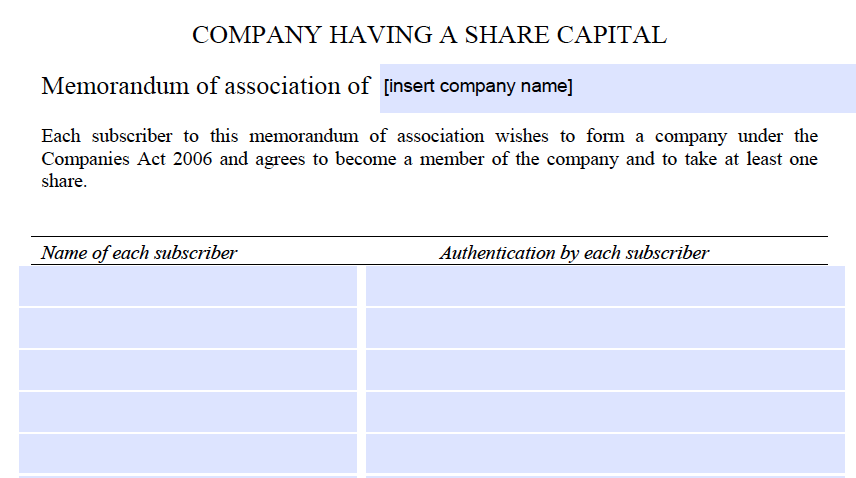

A limited company in the UK can issue new shares. The Companies Act 2006 governs the process of issuing new shares and sets out the rules and regulations companies must adhere to. However, before proceeding with the issuance, you should check your company’s Articles of Association to ensure there’re no restrictions on issuing new shares.

How issuing new shares impacts share price

Not to be mistaken with a share transfer (where the company receives no new money), when a company issues new shares, the total number of outstanding shares increases. As a result, the ownership stake of existing shareholders is diluted.

The value of each individual share may decrease because the company’s total value remains relatively unchanged, but it’s divided among a larger number of shares. This dilution may lead to a decline in the company’s share price, impacting existing shareholders’ interests.

Calculating new shares issued

To calculate the number of new shares issued, you need to determine the amount of capital you want to raise and the issue price per share. Divide the total capital raised by the issue price per share to get the number of new shares to be issued.

Ordinary vs special resolutions

You generally need a resolution to issue new shares in a UK company. The Companies Act 2006 requires private companies to pass an ordinary resolution, while public companies need to pass a special resolution. Your company’s Articles of Association may also have specific provisions related to issuing new shares, so make sure to review them carefully.

Directors and issuing new shares

In most cases, directors don’t have the inherent power to issue new shares without shareholders’ approval. As mentioned earlier, a resolution is required to authorise the issuance of new shares. However, there might be specific situations where the Articles of Association grant directors the power to issue shares up to a specific limit. It’s vital to understand your company’s constitutional documents and consult legal professionals if needed.

Issuing new shares to raise capital

One of the common reasons for issuing new shares is to raise capital for your business. Whether you’re looking to fund a new project, expand your operations or strengthen your financial position, issuing new shares can be an effective way to raise funds.

By offering shares to investors, you provide them with an opportunity to become part-owners of your company, and in return, they invest money into your business.

Issuing new shares to reward employees

Issuing new shares can also be a means to incentivise and reward your employees. Employee share schemes, such as Company Share Option Plans (CSOPs) or Share Incentive Plans (SIPs), allow you to grant shares or share options to your employees. This not only motivates your staff but also aligns their interests with the success of the company.

Ensure compliance with legal requirements

Before issuing new shares, ensuring compliance with all legal requirements is important. Engage a qualified solicitor or company secretary to guide you through the process and help draft the necessary documentation. Proper compliance will protect your company from legal disputes and potential complications in the future.

Notifying Companies House

As a limited company issuing new shares, you must notify Companies House of the changes to your share capital. The prescribed forms, such as SH01 for allotment of shares, must be submitted to Companies House within specific timeframes. This ensures transparency and accuracy in the public records.

Free Tide Business Bank Account - £50 Cashback!

Open a free business current account to qualify + enjoy 12 months free transactions. Read our Tide review.

The SH01 form doesn’t require details of the shareholders to whom shares have been issued, just the shares themselves. However, you’ll need to include details of who owns how many shares in the company’s next Confirmation Statement.

Informing existing shareholders and your registers

Lastly, you need to keep your existing shareholders informed about the issuance of new shares. Existing shareholders have rights, and their interests may be affected by the issuance. Providing them with clear and timely information helps maintain transparency and fosters a positive relationship between the company and its shareholders.

It’s good practice to update your register of members and register of allotments too.

Wrapping up

Issuing new shares in your UK-based limited company can be a strategic move to raise capital and incentivise employees. However, following the legal requirements and seeking professional legal advice is important to ensure a smooth and compliant process. By understanding the implications of issuing new shares, you can make informed decisions that benefit your company and its stakeholders.

If you’re unsure about issuing new shares in your limited company, speak to the corporate lawyers experts at LawBite. They will be able to guide you through the process and ensure you follow all the laws and regulations that govern your company.